By Ronald Jasgur

There is money on the table that no one’s claiming, money to be recovered in sales of distressed assets, left and right.

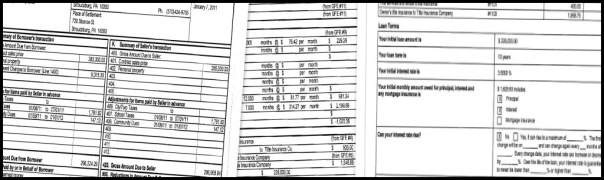

Why, exactly, are banks and servicers seemingly not concerned about the bottom line on the HUD-1 settlement statement?

It’s easy to answer. The people responsible for selling these assets (note: not houses or homes, they’re assets or properties, cold, distant, indifferent) are doing a job, punching a clock, checking off a list, meeting quotas.

There is no personal ownership of assets, so it’s hard (read: impossible) to adopt a private seller’s psyche when working at a bank or servicing firm. An asset manager has never seen the house other than pictures sent via email, and he’s relying on agents on the street to give a true-to-life indication of what’s really going on.

These folks have performance targets to hit – how many can they get under contract, how many can they get to closing, and how quickly. It’s a numbers game, and once a price has been determined by the bank, it’s that price and only that price that asset managers are working toward.

There is no incentive to go higher. It’s just a job, remember, one task on a long list.

But here’s the thing. If the asset manager were actually a private seller, he’d want to claim every penny possible in the shortest amount of time. He’d care.

As it stands, asset managers are tasked with disposing of hundreds of properties across the country. No personal attachment. It’s a video game on a screen, not an ownership problem with a living, breathing person behind it.

So what’s the solution?

For one, it’s incredibly important to have asset managers only manage properties in a specific geographic area. Keep it local, keep it known.

Real estate by nature is local – there is no correlation between what happens in Birmingham, Michigan and what happens in Birmingham, Alabama. Same goes for loss mitigators handling short sales.

Some of the banks we work with are finding it beneficial to send negotiators and asset managers into the field: see the neighborhoods, smell the properties, spend quality time with agents they hire. Look at the inventory. A few days in the field more than pays for itself.

Lastly, any asset manager or loss mitigator who has never purchased a home themselves shouldn’t be negotiating a sale. It’s impossible to understand what an owner-occupant buyer is going through, especially in today’s real estate environment. We need experiential compassion to get the market moving again.

Far too many good deals are killed over insignificant items because, without personal attachment to the property or emotional investment in the sale, it’s easy to kick a buyer to the curb and move on to someone else.

This shouldn’t be about collecting a paycheck and which bank’s name appears on the mortgage. Develop a sense of ownership over every asset, and we’ll see some of these unnecessary losses vanish, and more dollars recovered.